Perhaps your financial education began with entrepreneurial ventures like a lemonade stand on a scorching summer day or with your parents setting up an allowance system. Maybe it was during a family game night playing Monopoly, where landing on Free Parking seemed like a windfall (Fun Fact: not an official rule!). However, whether through these experiences or others, many of us likely didn't receive thorough preparation for the financial complexities of adulthood.

Financial education is vital, comparable to teaching personal hygiene or history. Even if a child struggles with household chores, they should learn money management, fostering self-reliance. Research shows that good financial habits lead to higher confidence, reduced stress, and clearer goals. It's about empowering our children to make thoughtful choices. Adarsh (Adi) Shyamsundar, owner of Polaris Capital Management in El Dorado Hills, emphasizes that it’s about cultivating a mindset of planning and accountability, not just focusing on numbers. Being a father of two boys (ages 10 and 13), he recognizes the significance of introducing financial education to children early on. He has even conducted a personal finance class at a local middle school, acknowledging the absence of such education in our school system.

Here are some strategies he recommends for parents to help their children invest in their financial future:

Introduce the Value of Money

Adi suggests a simple approach: parents should teach children about money from a young age, explaining its nature and the reasons for spending or saving. As kids mature, it's crucial to discuss earning money and differentiate between essential needs and optional wants.

Budgeting Basics

The best way to start a budget with your kids is to begin by recording the money they have and then categorizing their expenses, ensuring that saving and investing are included in the budget plan.

Save, Save and Save Again

Encouraging financial responsibility, parents should guide their children to set aside at least 15% of their allowance or earnings for savings or investment. Furthermore, it is pivotal to help them define objectives for significant expenditures, such as acquiring a phone, a gaming console, or their first car.

Cracking the Code of Credit Scores

The official age to obtain a credit card is 18. However, Adi points out that in many cases, parents can add their child as an authorized user to help them build credit history and impart financial discipline. However, it's important to note that the parents are liable for any charges made on the card, so a teaching opportunity around trust may follow.

Summertime Jobs

Summer jobs offer teenagers an excellent opportunity to earn money and gain practical experience in handling financial responsibilities. One surprising aspect for teens entering the workforce is learning about the deductions from their paychecks. These temporary positions allow teens to earn income without disrupting their studies during the school year and may also help them explore and identify their passions.

The Happiness of Giving

Studies show giving boosts happiness, health, and social connections, inspiring others. It's vital to teach kids generosity in financial education, shaping them into empathetic, responsible individuals who contribute to society.

Mistakes Happen, and That’s Okay

Life presents moments akin to landing on Park Place; promising yet already claimed, while Boardwalk thrives with hotels. These experiences often involve regrettable decisions, but they're natural and offer growth opportunities. Mistakes provide valuable lessons, enabling us to recalibrate, learn, and move forward toward success.

Understanding the Digital World

In the digital age, financial transactions are effortless, but online security is crucial. Understanding cybersecurity basics is vital, especially with the rise of cryptocurrencies. Platforms like Reddit expose individuals to speculative strategies. Adi notes the wealth of online learning platforms for teens, but parents must navigate challenges in monitoring content. Engaging with teens helps guide them towards reliable resources, fostering critical thinking skills.

Resources for Teens

Adi offers his suggestions to enhance your child's financial literacy.

Apps:

-

Money Masters

-

Trading Game

Books:

-

The Infographic Guide to Personal Finance - A Visual Reference for Everything You Need to Know (Infographic Guide Series) by Michele Cagan CPA and Elisabeth Lariviere

-

The Psychology of Money: Timeless Lessons of Wealth, Greed and Happiness by Morgan Housel

Applying these valuable tips to foster a positive mindset in money management in our children can set them on a trajectory toward greater financial success in the future. The objective is not to dictate what they should do with their money but rather to guide them in developing thoughtful perspectives and a deeper understanding of the choices they make.

It's about empowering our children to make thoughtful choices.

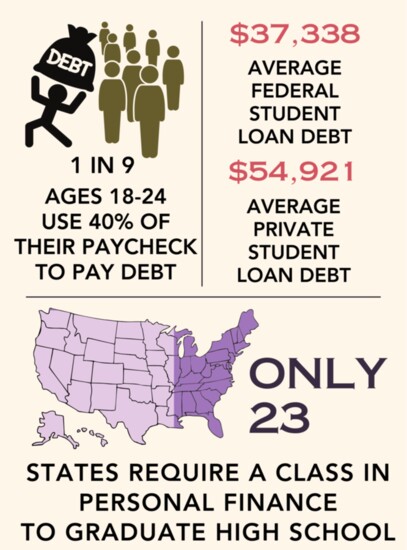

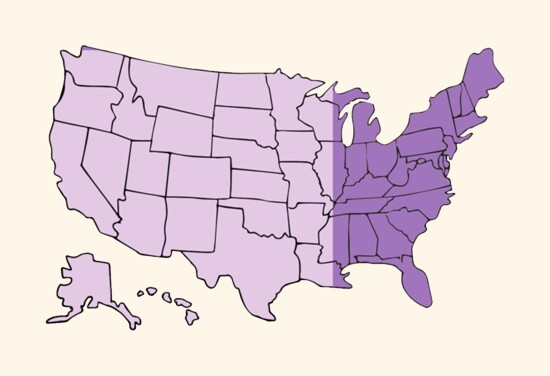

1 in 9 Ages 18-24 USE 40% OF THEIR PAYCHECK TO PAY DEBT