Women in venture capital on Mercer Island are not only breaking barriers but also creating powerful opportunities for education, mentorship, and involvement for anyone looking to make a difference in a male-dominated industry.

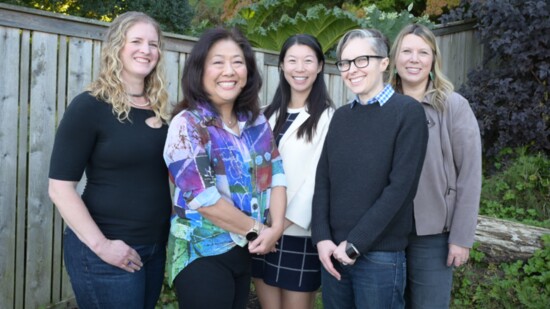

At intimate house parties, women like Jennifer Wrenn Henry, a fund manager at VentureUs, are creating spaces where founders, investors, and mentors can connect, share knowledge, and support each other’s growth. “We’re gathering at my place tomorrow night, and it’s all women VCs and founders,” says Henry. “But we’re not just here for networking—we’re here to help each other move forward, whether that’s by reviewing a pitch, introducing someone to the right people, or just offering advice.”

These events are inclusive and collaborative, offering valuable educational experiences for everyone involved. “Everybody who turns up at one of these card games gets a chance to talk about their company or share what they need,” explains Nellie Fujii Anderson. “It’s a very generous community.” Founders, particularly those underrepresented in venture capital, find not just support but an educational space where they can get real feedback and learn how to navigate the complexities of growing a business.

This collaborative, open approach also allows mentors and investors to play a crucial role. “We need more diverse decision-makers on the other side of the table, and that’s one of my missions,” says Henry. As venture capital shifts toward more diverse leadership, the need for experienced mentors and sounding boards will only grow. You don’t need to be a seasoned investor to make an impact; whether you’re offering strategic advice or connecting someone to their next opportunity, your role as a mentor or advocate could be instrumental in helping someone’s business succeed.

In addition to funding underrepresented founders, these female investors focus on different parts of the ecosystem such as AI, and VR. “I am working with a group that’s focused on investing in clean tech opportunities, really focused on climate,” said Karin Kidder, executive director at E8 Angels. “It’s to accelerate the transition to a cleaner, greener, environment…We’re a non-profit membership organization. We exist to connect individual investors with opportunities to invest into the sector.”

Elizabeth Scallon, co-founder of Find Ventures, highlights the importance of offering practical, actionable support to founders. “Founders don’t just need mentorship—they need funding. But we can help them understand how to get that funding, how to validate their business ideas.” Whether you’re a seasoned investor or someone with industry expertise, your knowledge can be the key to helping founders take the next step.

For those looking to get even more involved, there are opportunities to become investors or even co-founders. With a looming $30 trillion wealth transfer expected by 2030, many women will find themselves in control of significant financial assets. This presents a unique chance for new investors to enter the VC world, support underrepresented founders, and fuel innovations that could shape the future.

“This is one of the highest capital areas in the world,” says Scallon. “There’s no reason Mercer Island couldn’t lead the way with its own city venture fund, investing in local founders and innovative solutions.” Whether you’re ready to invest or simply want to be part of the conversation, this is a community that welcomes all contributions, from advice to financial backing.

To learn more about how you can get involved—whether as a mentor, sounding board, investor, or even a founder—visit VentureUs.org for information on upcoming events and opportunities to connect. The future of venture capital is inclusive, collaborative, and ready for your participation.

“We met with leaders from ex-Microsoft and Amazon, people who have been in this space for awhile, and they get their feedback and suggestions on our tool,” said Amy Yan, co-founder of Nowadays.ai, an online portal for corporate event planning. “VentureUs was instrumental in closing our final round of funding.”