Grow your knowledge of finances with these educational book selections for all ages from the MidPointe Library System. Learn to share, save and spend from the many community resources available at their local branches, from books to programming, all under the help of their professional team of librarians.

Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom and Building a New American Middle Class

by John Hope Bryant

Former Vice-Chairman of the U.S. President’s Advisory Council on Financial Literacy, John Hope Bryant delivers an accessible and powerful resource to build a strong financial foundation. This book is an easy-to-read first step toward a fulfilling financial future, helping you understand your relationship to work and money and a key component to untangling the surprisingly simple puzzle of personal finance. You’ll learn how to create wealth for yourself and your family, regardless of your educational or employment background and how to establish a financial mindset that contributes to a sound future.

Crush Your Money Goals

by Joy Bernadette

When it comes to building financial health, adopting good money habits that will last (and dropping bad ones) can ensure financial freedom. In Crush Your Money Goals, you will find information on the psychology behind why habits work to achieve goals, twenty-five simple habits to adopt and which to drop, to help you invest properly, budget, save, climb out of debt and so much more.

Invest Like a Girl: Jump into the Stock Market, Reach Your Money Goals and Build Wealth

by Jessica Spangler

In a world where many women need to contend with the gender pay gap, take career breaks to raise families and account for their longer lifespans when saving for retirement, investing is a surefire way to achieve firm financial footing. When women do start investing, they often land higher returns than men. Understanding that investing is crucial is just the beginning. Filled with easy-to-implement tools, practical strategies and real-life examples, this go-to guide to investing provides the blueprint for you to take the next step with your money.

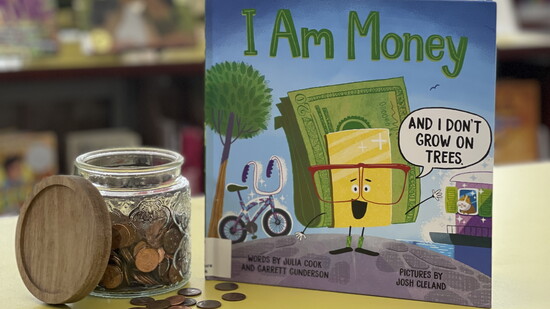

I Am Money: and I Don’t Grow on Trees

by Julia Cook + Garrett Gunderson

Illustrated by Josh Cleland

Introduce kids to the basics of money with this easy-to-understand picture book. Readers will learn about how to earn and save money, spend money wisely and even use money to invest in themselves. But the best part of money is sharing it! The simple text also helps explain the different forms money can take, like cash, cards and even crypto. Additional fun facts and money tips in the back make this book a great teaching tool for curious kids and aspiring entrepreneurs!

Give It! A Moneybunny Book

Written + Illustrated by Cinders McLeod

In this delightful introduction to simple money concepts, an enthusiastic young bunny discovers how good it feels to use his allowance to help others. Chummy wants to save the world—or at least Bunnyland—from dragons, so spending his carrots on a superhero costume seems like a great plan. When his grandma reminds him that there aren't any dragons in Bunnyland, but that there are creatures that could use help, Chummy starts reconsidering the best way to spend his wad. This is the fourth book in the internationally acclaimed series.

A True Book: Making and Saving Money

by Janet Liu + Melinda Liu

How can I make money? What is inflation? What is the difference between a debit card and a credit card? Economics—and more specifically, money—plays such a large role in our lives. Yet there are many mysteries and misconceptions surrounding the basic concepts of finance and smart money management. This book offers students the know-how they'll need to start on the road to financial literacy—a crucial skill for today's world. Interesting information is presented in a fun, friendly way—and in the simplest terms possible—enabling students to build strong financial habits early on in life.