In an era of day-trading, meme stocks, and robo-advisors, there is something deeply reassuring about walking into an office where people still use file cabinets. At Googins Advisors in Middleton, the technology is up-to-date, but the crisp, warm atmosphere is decidedly timeless. It feels less like a Wall Street trading floor and more like a living room where someone happens to be very good at math.

Louise Googins founded the firm in 1978 with a phone book and a surplus of determination. She spent her days dialing strangers and giving her spiel, an exercise in grit that would break most people in a week. She quickly realized that she didn't want to chase people into their kitchens to make a sale. She wanted to be a destination…envisioning a space where people would come to her for clarity…with an office where she could look someone in the eye and give them the straight story on their future.

She did not set out to build a financial empire; she simply wanted to help people make their money work harder. She saw that teachers, laborers, and everyday folks were accepting low rates of return simply because they didn't know better. She took that interest and turned it into a fixture of the Middleton community. For nearly fifty years, she has built the business with her own two hands and a philosophy that prizes clarity over complexity.

"We don't lie to people," Louise says. "We explain things to them. Sometimes they don't want to hear it, but we just tell people what's good for them." That directness is a Louise signature and has affixed itself as a company value.

While Louise has recently stepped back to let the next generation lead, the team picks up what she’s putting down. Michael Googins, Louise’s son, has spent thirty years on and off with the firm and now bridges the gap between Louise’s founding principles and the current client needs. He sees the value in being real with people and understands how his mother earned rapport in the community. "I know how she acts," Michael says of his mother, "which is a bit unusually open and honest and just no nonsense.”

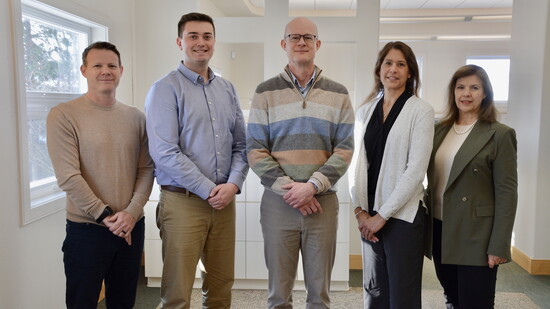

The crew, small by design, is guided by ‘the Louise transparency guidelines.’ Whether setting a meeting with Michael, reviewing a financial plan with Rick, reallocating your assets with Lynne Goldsmith, thanking Cole for a cup of coffee during a meeting, discussing a money transfer with Kim Rankin, exchanging a warm hello with Dayton Hoffman, or receiving a dry wisecrack of wisdom from Louise as she reads the daily newspaper, everyone is invested in your investments, operating as a collective brain. With Louise in mind, they are quick to develop a level of open trust with their clients through fact-of-the-matter knowledge. Their cohesive unit is the hands-on team your heart desires in an increasingly automated world.

Rick Martin, a financial advisor who joined the firm five years ago after leaving a large corporate firm in Michigan, represents the bridge between tradition and modernity. He admits he is a "yellow pad of paper and pen" kind of guy. "I learned on a yellow pad, calculator, and pen," Rick says. "Having the ability to also switch to technology is the biggest difference between how things operated back then vs now, but you can still retire people off a yellow pad because we’ve been doing it for fifty years."

You can see this philosophy in the office itself. There are computers, certainly, but they live in harmony with rows of sturdy file cabinets. It is a visual reminder that while algorithms can track the market, they cannot track a relationship.

Rick found the transition to the smaller firm refreshing. He fits right in with the "Midwestern nice" culture that defines the firm. "I believe that there is more of a sense of community," Rick says of working in Middleton compared to larger metro areas. "People are nicer...it’s a breath of fresh air."

This community focus isn't just about being polite. It is about understanding the specific lives of the people walking through the door and knowing that a client isn't just an asset allocation model; they are a grandmother trying to set up a custodial account, or a family deciding if they can afford new windows.

Michael notes that many clients come in feeling anxious, believing they need a complex plan when what they really need is the confidence to invest the savings they have already accumulated. This is where the team excels at turning savers into investors.

This approach has created multi-generational loyalty. The team is now helping the children and grandchildren of Louise’s original clients. They have become the first call when life happens, whether it is a birth, a death, or a simple loan offer. "Clients that are around that long become friends," Michael notes. It turns out that when you treat people well and help them secure their future, they tend to stick around. "You should be financially independent," Louise states, "and we can help you."

"You’re always an individual to us. We will take care of you and see that your needs are met."

"We make investors out of savers. Most people who come here are good savers. They just need direction. Saving isn’t the problem. It is placing it in the right area to grow on its own."